Venture capital (VC) is a type of private equity, a form of financing that is provided by firms or funds to small, early-stage, emerging firms that are deemed to have high growth potential, or which have demonstrated high growth (in terms of number of employees, annual revenue, or both). A simplified industry Usually, the processes of acquiring funds from venture capitalists are quite stringent and sometimes the standards become unattainable for a lot of startups and small businesses. These is most times due to the regulatory fintech environment within which venture capitals operate and the sheer pursuit of maximum protection from investors’ funds. Also, the regional nature of operations of such platforms restrict the how far both investors and fund seekers can go in the pursuit of the financial goals in terms of venture capital. With the emergence of blockchain and cryptocurrencies, the financial world as a whole is seeing a revolution that is sweeping across every part of the industry. The methods applied by companies, especially startup and small businesses to raise funds has changed drastically. Initial Coin Offering (ICO) is an unregulated means by which funds are raised for a new cryptocurrency venture. This method is used by startups to bypass the rigorous and regulated capital-raising process required by venture capitalists or banks. Adapting to the trend In a fast moving world that is powered by the internet and modern technology, VCs are faced with the problems of being too complicated, too slow, reducing funding startups and having seeding processes that are difficult to complete. Therefore, most companies and startups are now embracing the ICO methods of fundraising by adopting blockchain technology. The independent nature of ICOs warrants that project owners need to build a team of developers, advisors, legal and regulatory experts, marketing teams and KYC/AML checks during the ICOs plus find investors. This is often a huge task take requires a lot of time and resources. These early tasks often pose a great challenge for most startups that they barely make it through.

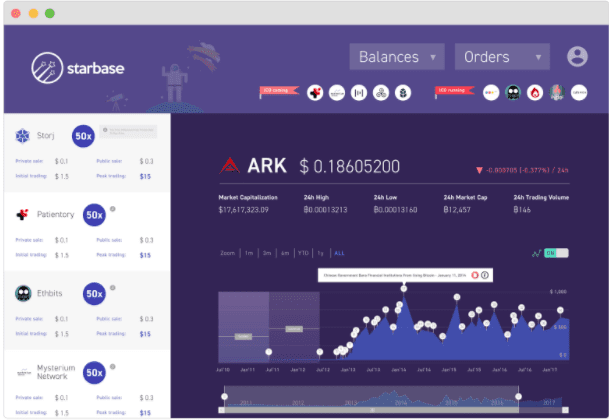

Everything in one place Simplifying this process for users and creating a one-stop shop for ICO solutions is the goal of Starbase platform. Starbase is a user-centric global crowdfunding and token payment platform which connects people who want to develop challenging projects like startup companies or other kinds of innovative ideas with people like investors, engineers, designers, or marketers who want to support these projects all over the world. With Starbase everything is decentralized and executed at very little cost, innovators do not need to convince individuals or corporations for funds, neither do they need to spend huge initial funds on legal fees or marketing as they ride on the visibility on the Starbase platform. This takes off all external distractions from innovators and allow them to focus primarily on developing their ideas. STAR is the lead token of the Starbase platform and the base currency for ICO investments. The STAR Token Crowdsale starts on Nov 9th 2017 15:00 UTC and ends Nov 17th 2017 15:00 UTC. Other key benefits Some of other key benefits offered by the Starbase platform include:

Using the blockchain, product owners can share flexible long-term incentives with their team members in a fast, cheap, and global way. Utilizing Bitcoin, Ethereum or other major cryptocurrencies, projects can raise necessary resources on a global scale. Product creators can engage with engineers, entrepreneurs, marketers and other professionals from all over the globe. Using the Starbase platform, projects can be accelerated by implementing a functional reward system based on contributions to an interesting project. Those that work the hardest, reap the most rewards. The Starbase platform brings full transparency to a project’s members and assets. Since this can be publicly verified on the blockchain, this enhances liquidity for token trading on the exchanges. Starbase Tokens holders will be rewarded quarterly.